Ready to sell your home? We can help maximize your largest asset and Arrive at your goal.

We know that selling your home can be an emotional and sometimes overwhelming process. We want to help. We believe that a detailed and well-executed marketing and sales plan will achieve the best results for you. The following 6 steps outline what we will do to evaluate, prepare, market, negotiate and sell your property for the best price.

Discuss with Agent

-Discuss with the agent to review the finalized details and ensure all necessary preparations are in place for the upcoming steps. Coordinate any remaining tasks or considerations, such as scheduling appointments, confirming timelines, and addressing any outstanding concerns. Collaborate closely with the agent to ensure seamless communication and alignment throughout the process, facilitating a smooth transition to the next stage of the transaction.

-

- Schedule a viewing of the property to get a firsthand look at its condition, features, and potential. Take note of any aspects that stand out or may need attention.

-

- Clarify your timeline for selling the property, including any specific deadlines or preferences you may have. This will help your agent tailor their approach to meet your needs effectively.

-

- Familiarize yourself with the selling process, including the steps involved, legal considerations, and potential challenges. Your agent can provide guidance and answer any questions you may have.

-

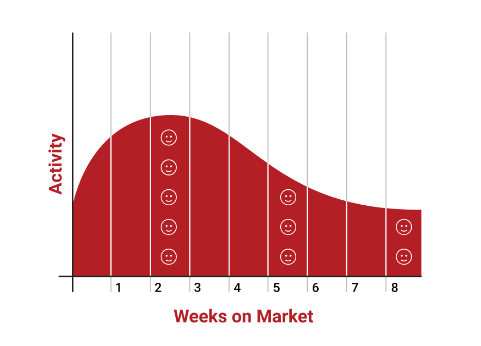

- Based on our market analysis and property evaluation, we'll collaborate on a pricing strategy that positions your property competitively in the market. Our goal is to attract qualified buyers while ensuring you receive the best possible offer for your property.

-

1. Determines property value by comparing it with similar recent sales.

2. Sets competitive prices for sellers and offers guidance for buyers.

3. Provides insights into market trends.

4. Serves as a negotiation tool.

5. Helps assess property condition and features.

6. Is often required by lenders for mortgage approval, ensuring accurate property valuation.

-

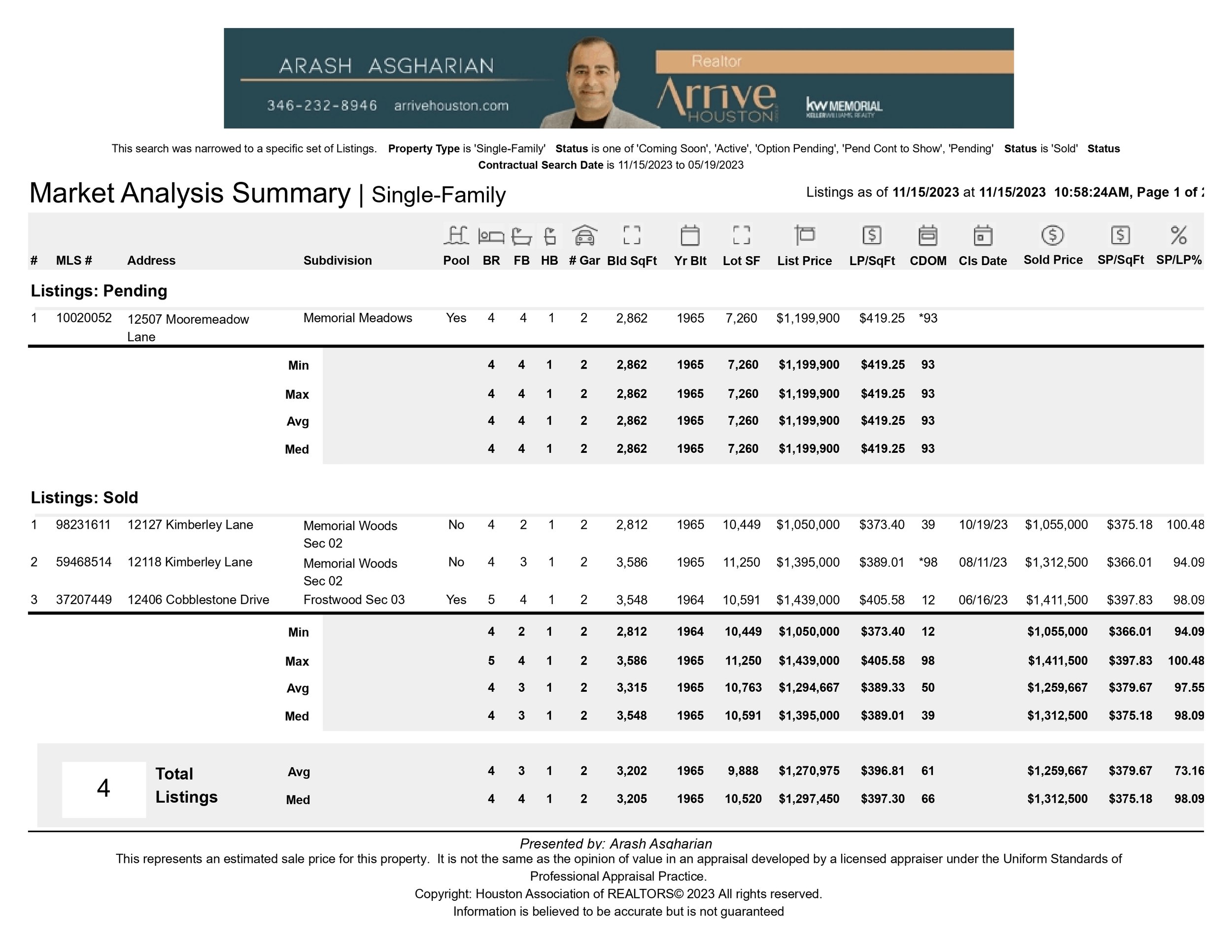

- Conduct a Comparative Market Analysis (CMA) to determine the house's market value accurately. This involves reviewing recent sales of comparable properties in the area to assess the property's worth relative to the current market conditions.

Signing Paperworks

-Coordinate with your agent to finalize paperwork signing arrangements. Ensure all necessary documents are prepared and reviewed beforehand for accuracy and completeness. Confirm the location, time, and any additional requirements for signing. Work closely with your agent to address any questions or concerns and streamline the paperwork process, ensuring a smooth and efficient experience.

-

1. **Services Provided:** Understand the scope of services outlined in the agreement, including listing your property, negotiating on your behalf, and facilitating the transaction process.

2. **Duration and Termination:** Clarify the duration of the agreement and any provisions for early termination, ensuring that you're comfortable with the timeline and flexibility.

3. **Fees and Commissions:** Review the details regarding fees and commissions payable to the brokerage upon a successful transaction, ensuring transparency and understanding of financial obligations.

4. **Exclusive Representation:** Determine if the agreement grants the agent exclusive representation rights and consider the implications of working exclusively with that agent for the specified duration.

-

- Begin with initial repairs and updates to enhance the property's appeal and address any issues that could deter potential buyers.

- Stage the home to showcase its best features and create an inviting atmosphere that resonates with buyers.

- Invest in professional photography and videos to capture high-quality images and highlight the property's unique selling points effectively.

-

- Once the preparation is complete, list the property in the Multiple Listing Service (MLS) to make it visible to a wide audience of buyers and real estate professionals.

- Ensure that all relevant details and information about the property are accurately presented in the MLS listing to attract potential buyers and generate interest.

-

- Implement a comprehensive marketing strategy to promote the property across various channels, including online platforms, social media, and print advertising.

- Utilize targeted marketing tactics to reach specific buyer demographics and maximize exposure for the property.

- Monitor the effectiveness of marketing efforts and adjust strategies as needed to optimize results and attract qualified buyers.

Receiving Offers

-Engage with your agent to discuss received offers, reviewing each offer thoroughly for terms and conditions. Collaborate on evaluating the strengths and weaknesses of each offer to make an informed decision. Work closely with your agent to negotiate terms and guide you through the process, ensuring your interests are represented effectively.

-

- Initiate negotiations with the buyer to discuss terms, including price, closing date, and any contingencies.

- Collaborate with your real estate agent to represent your interests and negotiate favorable terms that align with your goals.

-

- Once negotiations are finalized, agree on the terms of the contract and sign the necessary paperwork.

- Ensure that all parties involved understand and agree to the terms outlined in the contract before proceeding.

-

- Arrange for the buyer to wire option and earnest money to the title company as specified in the contract.

- Coordinate with the title company to facilitate the transfer of funds and ensure that all financial transactions are handled securely and in accordance with legal requirements.

*Note:

All financial transactions will be conducted through the title company, with funds securely deposited into an escrow account. It's important to note that only the title company has access to these funds, ensuring transparency and safeguarding against unauthorized access.

-

- Provide all required documents to the title company and lender (if applicable) in a timely manner to facilitate the closing process.

- Work closely with your real estate agent and attorney to ensure that all necessary paperwork is completed accurately and submitted according to the established timeline.

Option Period

-Communicate with your agent to discuss the option period timeline and implications. Review the terms and conditions of the option period in the contract, including any associated costs and responsibilities. Collaborate closely with your agent to make informed decisions within the option period timeframe, ensuring all necessary inspections and evaluations are conducted to your satisfaction.

-

- Schedule in-depth inspections of the property to thoroughly assess its condition and identify any potential issues.

- Work with qualified inspectors to conduct inspections covering various aspects of the property, such as structural integrity, electrical systems, plumbing, and more.

Note: In the event of the buyer terminating the option period, earnest money will be refundable, while the option money will be retained by the seller.

-

- Initiate the loan process with the buyer's lender to secure financing for the purchase.

Appraisal & Approval

-Coordinate with your agent to navigate the appraisal and approval process. Work closely together to ensure all necessary documentation is submitted accurately and promptly to the lender. Collaborate on addressing any potential appraisal issues and providing additional information as needed to support the approval process. Stay in communication with your agent throughout to facilitate a smooth appraisal and approval experience.

-

- Await the buyer's loan approval from the lender after completing the underwriting process.

- Communicate regularly with the buyer's agent and lender to monitor the progress of the loan approval and address any issues or concerns that may arise.

- Once the buyer's loan is approved, proceed with the closing process and finalize the sale of the property.

Note: If buyer terminate the contract during third party financing protection the seller needs to release the earnest money to the buyer.

-

-Upon approval of the buyer's loan, proceed with the appraisal and property approval process.

- Await the final underwriting approval from the buyer's lender, indicating that all conditions have been satisfied, and the loan is clear to close.

- Communicate with the buyer's agent and lender to ensure all necessary documentation and requirements are met to facilitate the final approval process.

Note: Should the buyer terminate the contract within three days of closing due to appraisal or property non-approval by the lender, the seller is obligated to release the earnest money to the buyer.

-

- Review the closing settlement statement carefully to ensure accuracy and completeness.

- Verify that all fees, credits, and expenses are accurately reflected on the statement and that there are no discrepancies or errors.

- Work closely with your real estate agent and attorney to address any questions or concerns regarding the closing settlement statement and ensure that all parties involved are in agreement before proceeding with the closing.

Closing&

Celebrating

-Coordinate with your agent to finalize closing arrangements and prepare for the celebratory culmination of the transaction. Review all closing documents meticulously and address any outstanding tasks or concerns. Collaborate closely with your agent to ensure a seamless closing process and celebrate the successful completion of the transaction. Reflect on the journey with gratitude and excitement for the new chapter ahead.

-

-When preparing to move out as a home seller, ensure the property is well-presented for potential buyers by cleaning and decluttering. Communicate closely with your realtor, disclosing any pertinent information about the property and coordinating timelines.

Arrange for utility transfers to occur a day after closing, ensuring seamless transition for the new owners. Prioritize securing the property and schedule a final walkthrough before the closing date. Share your forwarding address for mail redirection and offer comprehensive instructions for the incoming homeowners.

Lastly, emotionally prepare for the transition by focusing on the exciting opportunities ahead in your new chapter.

-

- Schedule the buyer's final walkthrough of the property to ensure that it is in the agreed-upon condition and all agreed-upon repairs have been completed.

- Accompany the buyer during the walkthrough and address any issues or concerns that may arise, ensuring their satisfaction with the property before closing.

-

- Finalize the closing date and ensure that all necessary parties are aware of the scheduled date and time.

- Coordinate with the title company and lender to ensure that all required documentation and funds are in place for the closing.

- Arrange for the seller to sign the necessary documents at the title company, and ensure that all funds are disbursed accordingly to complete the transaction.

-

- Take a moment to celebrate the successful sale of your home and the culmination of your hard work and efforts throughout the selling process.

Frequently Asked Questions

-

-During this meeting, the agent will gather information about the property, discuss the selling process, and address any questions or concerns the seller may have.

-

-The market value is determined through a Comparative Market Analysis (CMA), which involves analyzing similar properties in the area that have recently sold.

-

After signing the listing paperwork, the house preparation phase begins, which may include repairs, staging, and creating photo and video materials.

-

-The closing process begins with reviewing the closing settlement statement and ends with the closing date and funding, where the seller signs at the title company.

-

-The buyer will sign documents

( Buyer Termination and Release of Earnest money)

If the contract was cancelled within the contract’s terms then the seller needs to release the earnest money and the seller can keep the opion fee.

Unless there are objections, the seller needs to consult with an attorney.

-

Disclosed all your information about the house and inspection reports in the past 4 years.

-

-Offers from potential buyers are received and qualified, followed by negotiation and eventual contract execution.

-

-During the option period, further inspections are conducted at the buyer's expense.

-

-The buyer's loan process includes underwriting, appraisal, and final approval.

-

-The timeline can vary, but typically, the entire process after accepting an offer to closing can take 3-4 weeks or more depending on the loan process or various factors.

-

The agent will send you a seller’s estimated net sheet.

-

- Price Negotiation: This is often the primary focus of negotiations. Both parties will try to reach a mutually agreeable price for the property. Buyers may aim to negotiate a lower price, while sellers may try to maximize their profit.

Contingencies: Negotiations often involve contingencies, which are conditions that must be met for the sale to proceed. Common contingencies include home inspections, financing, appraisal, and sale of the buyer's existing home.

Repairs and Renovations: If issues are discovered during inspections, negotiations may involve who is responsible for making repairs or renovations, and how the costs will be handled.

Closing Costs: Negotiations may also involve who will pay for various closing costs, such as title insurance, attorney fees, and transfer taxes. These costs can be negotiated between the buyer and seller.

Timeline: The timeline for closing the deal may also be negotiated. This includes the date of closing, possession of the property, and any other relevant deadlines.

Terms of Sale: Apart from the price, negotiations may involve other terms of the sale, such as the inclusion of furniture or appliances, or any special considerations agreed upon by both parties.

Communication and Mediation: Effective communication and negotiation skills are crucial during this process. Both parties may enlist the help of real estate agents or attorneys to facilitate the negotiation and ensure that their interests are represented.

-

-A title company conducts a title search to verify property ownership and uncover any existing claims or liens. They also facilitate the closing process by handling paperwork, funds transfer, and issuing title insurance to protect against future claims on the property's title.